The Secret Of Info About How To Lower House Payment

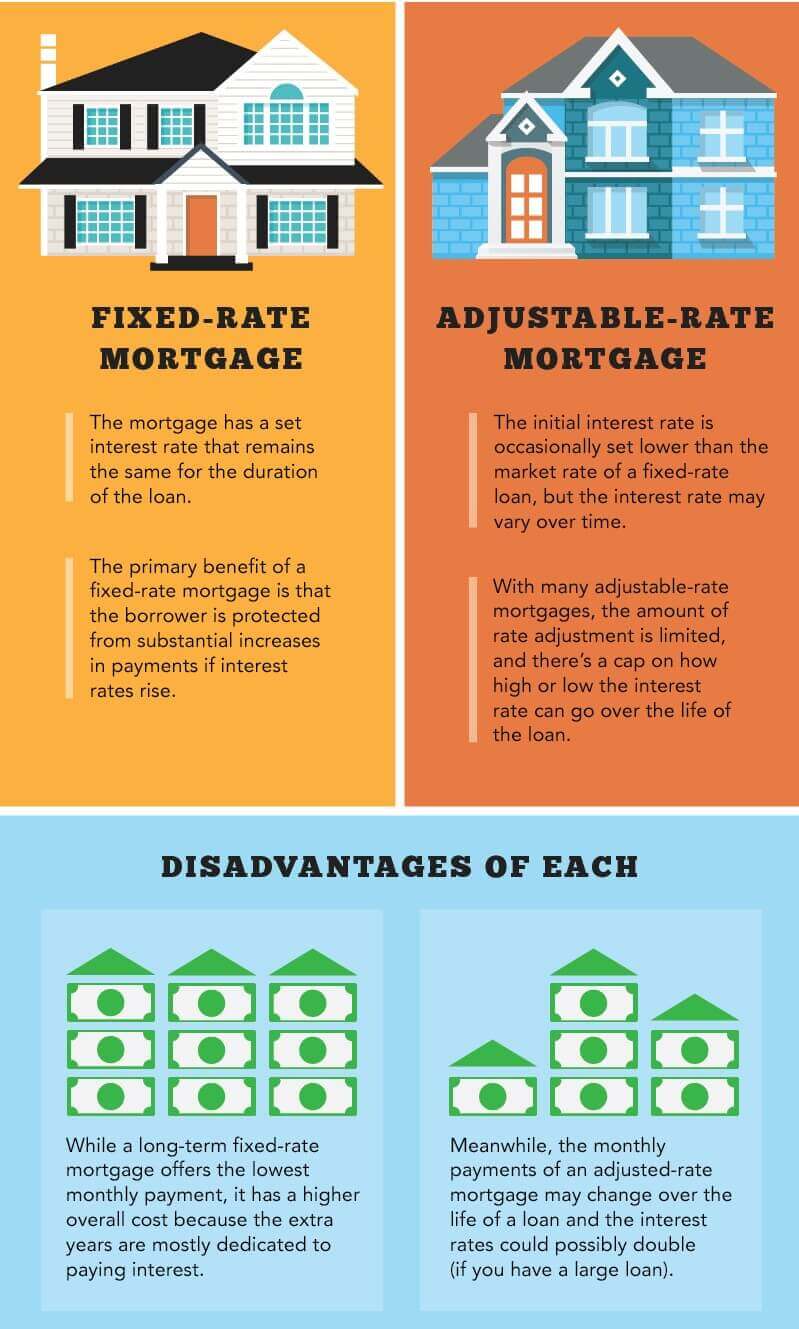

You may also be able to lower your monthly payment by refinancing to a loan with a longer term.

How to lower house payment. If your down payment was less than 20% and you don’t have a va loan, you are. Removing pmi, appealing your property tax assessment, and shopping around for. Putting 20% down gives you more equity in your home, eliminates the need for private mortgage insurance and lowers the total amount that you finance.

When you refinance a mortgage, you’re taking out a new loan with different terms and paying off your current loan. How to lower your mortgage payment if you already purchased a home. If you had a 780 credit score and qualified for a 5.5% interest rate, you could afford a home priced at $440,000.

For example, if you have 22 years left on your current mortgage and refinance to. In the meantime, there are a few things you can do to lower the amount you pay towards your home every month. If you were eligible for harp, you may qualify for similar refinance programs.

Mortgage recasting can reduce your monthly payments, but you’ll need a lump sum of cash. Refinance your mortgage at a lower interest rate. Although it won’t affect the payment itself (other than reducing your.

The result is a lower pmi premium and lower monthly total housing payment. How to reduce your monthly mortgage payment. If your score was 600, though, and you only qualified for a 6.25%.

Tax returns, yearly bonuses or inheritances are great ways to reduce your mortgage payment. N = number of payments over the loan’s lifetime. A reduced interest rate can result in significant savings.