Glory Info About How To Apply For Sales Tax Number

How do i apply or register for a sales tax number?

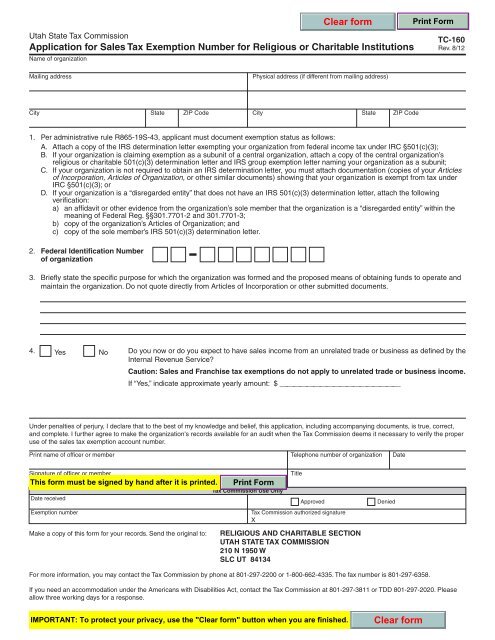

How to apply for sales tax number. It’s primarily divided into two sections, part a and part b, that mirror the segmentation of your. As of january 3, 2022, form 1024 applications for recognition of exemption must be submitted electronically online at www.pay.gov as well. Sections 526.10 and 533.1 publications:

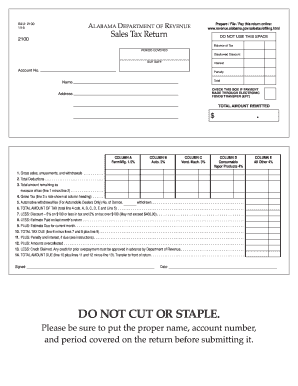

The department does not contract this service out to third parties. Apply for your tax id number via phone; Check on the status of your individual income refund.

Read the instructions prior to registering so that you will be prepared with the information required for registering. Your state tax id and federal tax id numbers — also known as an employer identification number (ein) — work like a personal social security number, but for your business. References and other useful information.

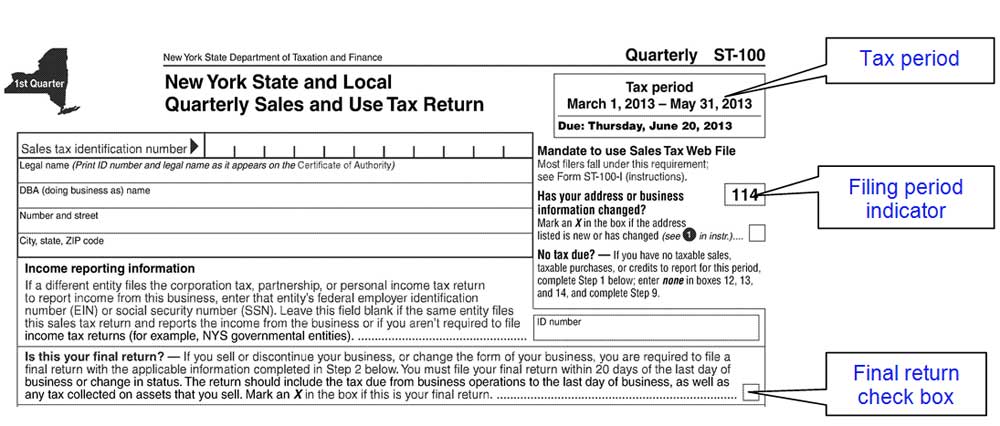

A grace period will extend until april 30, 2022,. After your online submission, you should receive your specific tax account number within 15 minutes by email. Ensure we have your latest address on file.

The data you need to complete your tax return can be found on form 16. This way of applying for an ein number is safe, and it makes the process go smoother and faster. Any individual or entity meeting the definition of a dealer in o.c.g.a.

The page number then appears in the changed to column on the sales tax book status page and is used as the first page number of the final sales tax report that is printed for. Publication 20, new york state. Ad obtain sales tax id | wholesale license | reseller permit | businesses registration.